333% increase in conversion rate

Addiko Bank has positioned itself as a leader in fast cash loans, focusing on convenience and speed. As a bank specializing in consumer and SME loans, they are unlocking opportunities with digitally empowered banking services.

Our job? Increase the number of successful applications for cash loans using performance marketing activities. The metrics used to measure the success – the number of successful loan applications, the average cost per application, and the conversion rate.

Services

- Digital advertising

- Analytics

- Design

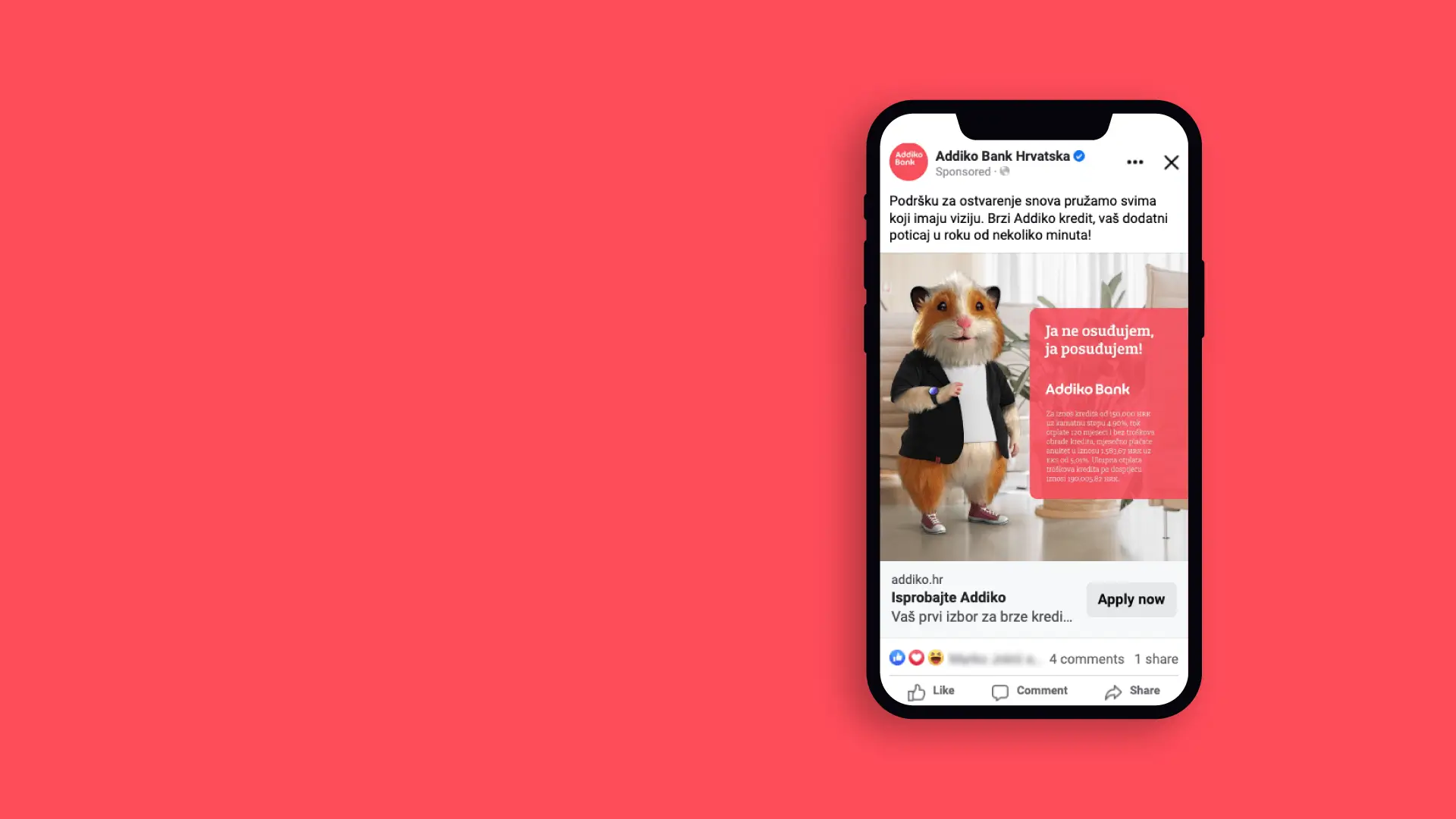

The main challenge while advertising cash loans was the economic uncertainty due to the pandemic aftermath, and speculations about a potential financial crisis. Introduction of the euro was an additional factor that lead to the increased uncertainty. In order to get as close as possible to users, and to strengthen the brand’s presence, we introduced a new brand character Oskar. The campaigns were optimized for reach, increasing website traffic and increasing conversions. We used ads that addressed real life situations, and offered a solution for user needs in order to further bring Addiko closer to users’ personal wishes and needs. Through the remarketing campaign, ads were shown to users who were already familiar with the offer, and by doing this, we maximized the possibility of conversions.

Brand building

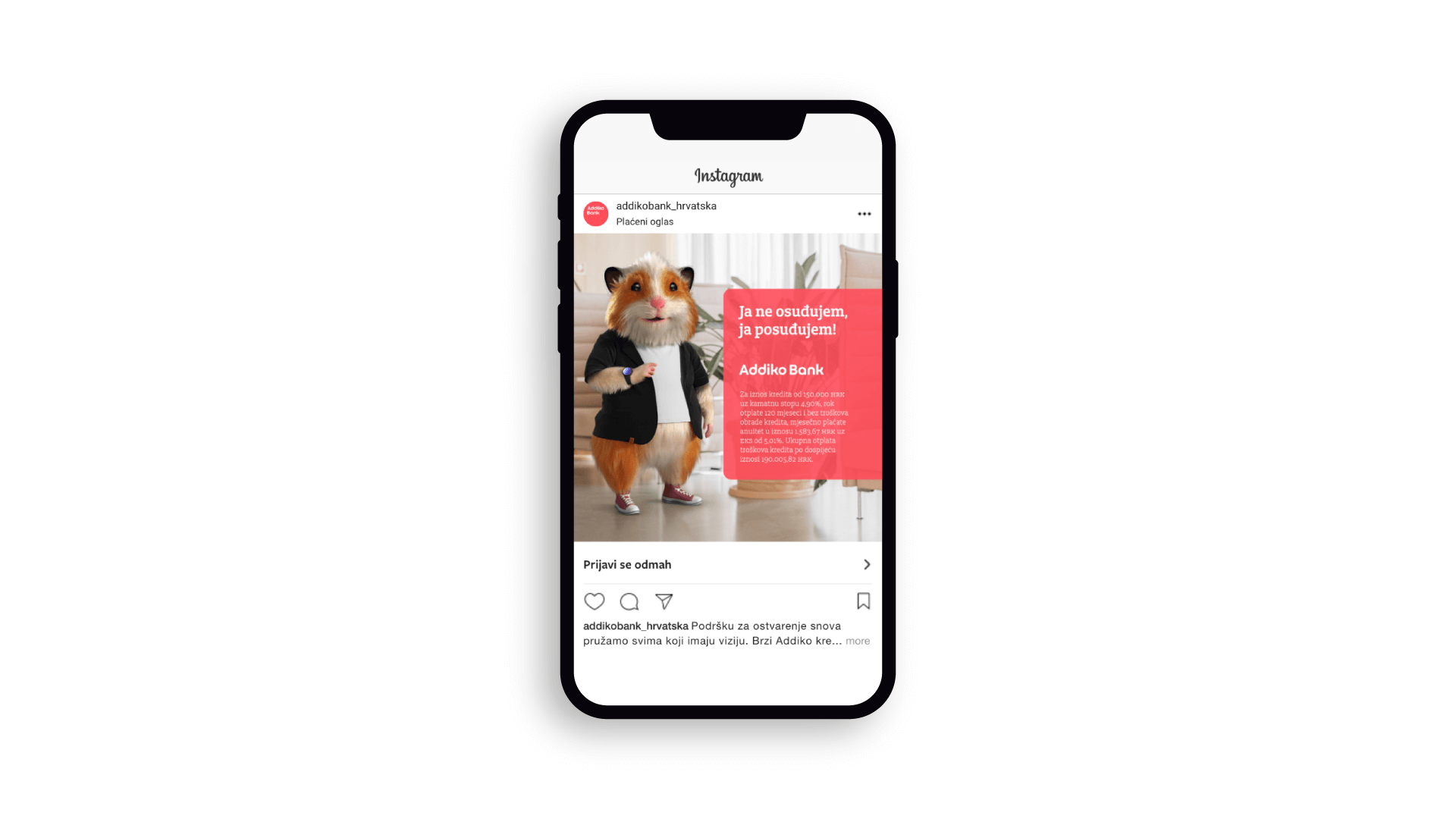

The campaign consisted of two phases. The first phase included spreading awareness of the new brand character and familiarizing users with the offer.

The second phase included activities aimed at maximizing the number of conversions. The promotional offer communicated ads that featured Oscar in order to position him in the minds of users as someone who wants to help them solve their problems.

Remarketing campaign

Through the remarketing campaign, we reached users with personalized communication messages depending on the stage of the loan application they were in. Google Display, YouTube, and partially Meta were used as channels to spread awareness of the offer, with 25% of the budget invested in them. Google Search, Discovery, and most campaigns on Meta were used to maximize conversions.

Results reflect rates in May 2022 compared to the previous 11 months.